Return Fees

Last Updated: February 26, 2026

Return fees can be applied when setting up your return policy.

ReturnGO supports several types of fees:

1. Restocking Fee

Charged per item.

This fee can be:

- Free

- Charged as:

- A fixed amount.

- A percentage of the item’s catalog price.

- A percentage of the item’s paid price.

2. Return Label Fee

Charged per RMA.

This fee can be:

- Not provided.

Note: This is used if you will not be issuing a pre-paid label on a policy rule. An example of this would be the ship with any carrier return method.

If a pre-paid label is not given by the merchant, there won’t be associated fees.

- Free

- Charged as a fixed amount

- Cost-based

- Cost

- Cost + per item fee

- Cost + per shipment fee

- Cost-based

Return label fees can be applied to policy rules that use either of these return methods:

- Ship with any carrier

- Ship with pre-paid label

3. Return Fee

Charged per RMA.

This fee can be:

- Free

- Charged as:

- A fixed amount.

- A percentage of paid price of each item in the RMA.

Note: Adding return fees of any kind is currently not supported when using the No Shipment Required return method.

Calculating the Overall Balance

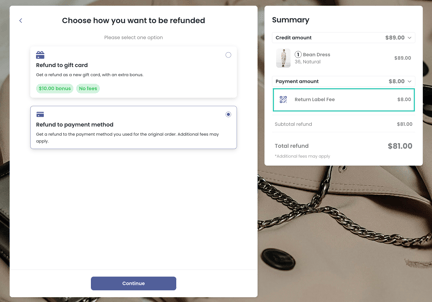

In the resolution selection page of the return portal, the available resolutions are presented to the customer, including a breakdown of how the balance is calculated, with the Refund Amount and the Payment Amount.

The overall balance is calculated as the paid price, plus all bonuses, minus all deductible fees.

What Does Paid Price Mean?

- The paid price represents the amount the customer paid in the original order.

- The paid price is calculated using the formula below:

- Paid price = catalog price - discount.

What are Bonuses?

Bonuses represent the sum of the following:

- Incentives that are offered in the resolution.

- In the case of an exchange, the price difference for choosing a cheaper variant.

What are Fees?

Fees represent the sum of the following:

- Restocking fee

- Return label fee

- Return fee

- In the case of an exchange, the price difference for choosing a more expensive product.

Note: In the case of multi-item returns, the return label fee is presented after the calculation of the subtotals per item.

Charging Return Fees

The return fees are accounted for when calculating the overall balance so that the overall balance shows the customer the amount they will get or pay.

If the overall balance is a positive amount, the customer can expect to receive a refund.

If the overall balance is a negative amount:

- ReturnGO will create a draft order that includes all the relevant fees. The customer will need to pay either via portal checkout or be invoiced, depending on your settings.

- For exchanges, the price difference for choosing a more expensive product will appear in a second draft order. This is the draft order for the actual exchange, and the customer may either pay via portal checkout or be invoiced, depending on your settings.

Note: If an RMA includes items that fall under different policy rules with different return label fees, the system will always apply the higher return label fee.

Configuring Return Label Fees

Return label fees can either be deducted from the refundable amount or charged separately. This can be configured either as a default or per policy rule.

To configure how return label fees are charged:

1. Go to Settings > Store Settings.

2. Open the General Returns section.

- Always apply a separate charge for return label fees.

- Deduct return label fees from refunds.

- Set return label fees based on policy rules.

4. Click on the save icon to save your changes.

Note: If Return Label Fees are set to Always apply a separate charge by default, or if at least one policy rule in an RMA is set to charge them separately, all return label fees in the RMA will be applied as separate charges, and the portal summary shows a refund-after-label-payment note.

Configuring Return Fees

To configure your return fees:

1. Go to Settings > Return Policy.

2. Open the policy rule to which to apply a fee.

3. Open the Additional Payments section.

4. Define the fees you want to charge.

- Select Do not charge additional fees for this policy rule if you don't want to apply any extra charges for this policy rule.

- Select Charge additional fees for this policy rule if you’d like to apply additional fees. You can then define which additional fees to apply:

- Restocking Fee (per item): Set the amount and how it will be calculated.

- Free

- Charge Fee: You can choose between:

- Fixed Amount

- Percentage of the item’s catalog price

- Percentage of the item’s paid price

- Tax Calculation: Choose whether to charge tax or not on the restocking fee.

- Return Fee (per RMA): Set the amount and how it will be calculated.

- Free

- Charge Fee: You can choose between:

- Fixed Amount

- Percentage of items’ paid price

- Tax Calculation: Choose whether to charge tax or not on the return fee.

- Return Shipping Label Fee (per RMA): Set the amount and how it will be calculated. Charge for a return label only if you provide one to your customers.

- Free

- Cost

- Cost + per item fee

- Cost + per shipment fee

- Fixed amount

- Label not provided

- Tax Calculation: Choose whether to charge tax or not on the return shipping label fee.

- Charge tax

- Do not charge tax

- Tax Calculation: Choose whether to charge tax or not on the return shipping label fee.

- Restocking Fee (per item): Set the amount and how it will be calculated.

Note: Return label fees can only be applied to a policy rule with a return method type of ship with any carrier or ship with pre-paid label.

When using Amazon MCF, cost-based return label fees are not supported. You must configure a fixed return label fee.

- Select Waive all fees in the RMA to override all other policy rule fee settings for the RMA. No fees will be applied to the customer for the return process.

- Display: Choose how the portal will display that all fees are waived when this policy rule is selected.

5. Click on the save icon to save your changes

Fee Taxation

Determine whether you want taxes to be applied to each of the fees you charge. You can specify whether each type of fee is taxable or non-taxable.

- Don’t add tax - Non-taxable fees mean that when the fee or its remaining balance is added to the Charged Fees draft order, tax will not be included.

- Add tax - If you set a fee as taxable, its price will be displayed without tax in the portal, and the tax will be applied when the customer is billed for the fee or its remaining amount.

You can set the default of which fees should be subject to tax, and additionally, taxation can be customized per fee at the policy rule level, making it possible to define fee taxation differently for specific policy rules.

On the RMA page you can view the taxes applied to the return label fee in the refund calculator.

To define the default settings for which fees will be taxed:

- Go to Settings > Store Settings.

- Open the General Returns section.

- Toggle each fee type to define whether to add tax to it or not.

- Click on the save icon to save your changes.

To define fee taxation for specific policy rules:

- Go to Settings > Return Policy.

- Select the policy rule you want to edit.

- Set the fees you want to charge for this policy rule.

- For each fee, set whether to charge tax or not.

Waive All Fees

You can create specific policy rules that will waive all fees in the RMA, so that if a customer selects multiple policy rules and one of them is set to waive all fees, then any fees associated with the RMA will be overridden.

To set a policy rule that will waive all fees:

- Go to Settings > Return Policy.

- Select the policy rule you want to edit.

4. In the Fees dropdown, select Waive All Fees.

5. Click on the save icon to save your changes.